While it may not be enough for some shareholders, we think it is good to see the Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) share price up 16% in a single quarter. But that doesn’t change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 20% in that time, significantly under-performing the market.

While the stock has risen 6.0% in the past week but long term shareholders are still in the red, let’s see what the fundamentals can tell us.

View our latest analysis for Dave & Buster’s Entertainment

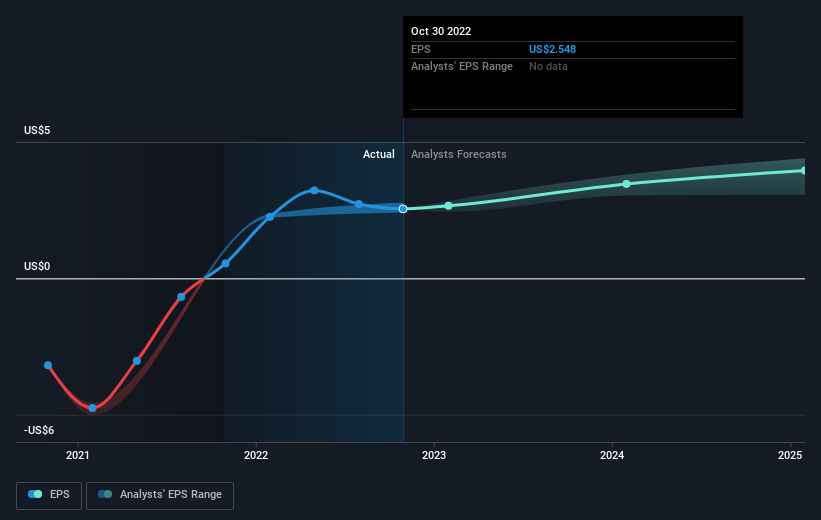

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it’s a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years over which the share price declined, Dave & Buster’s Entertainment’s earnings per share (EPS) dropped by 1.1% each year. This reduction in EPS is less than the 4% annual reduction in the share price. So it seems the market was too confident about the business, in the past.

The company’s earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It’s probably worth noting we’ve seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While it’s never nice to take a loss, Dave & Buster’s Entertainment shareholders can take comfort that their trailing twelve month loss of 3.0% wasn’t as bad as the market loss of around 20%. What is more upsetting is the 3% per annum loss investors have suffered over the last half decade. This sort of share price action isn’t particularly encouraging, but at least the losses are slowing. It’s always interesting to track share price performance over the longer term. But to understand Dave & Buster’s Entertainment better, we need to consider many other factors. Even so, be aware that Dave & Buster’s Entertainment is showing 1 warning sign in our investment analysis , you should know about…

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

What are the risks and opportunities for Dave & Buster’s Entertainment?

Dave & Buster’s Entertainment, Inc. owns and operates entertainment and dining venues for adults and families in North America.

View Full Analysis

Rewards

-

Trading at 19.4% below our estimate of its fair value

-

Earnings are forecast to grow 20.02% per year

-

Earnings grew by 383.7% over the past year

Risks

View all Risks and Rewards

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.